Hawaii paycheck tax calculator

Below are your Hawaii salary paycheck results. Both a state standard deduction and a personal exemption exist and vary depending on your filing status.

Calculator And Estimator For 2023 Returns W 4 During 2022

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Hawaii residents only.

. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Hawaii Hourly Paycheck Calculator Results. Kentucky is one of the states that underwent a tax revolution in 2018 making its tax rates much easier to follow and learnSince 2018 the state has charged taxpayers with a flat income tax rate of 5In addition taxpayers generating income in the state also have to pay local income taxes which vary between 0000075 and 250.

It is not a substitute for the advice of an accountant or other tax professional. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. From 225000 to 262500.

Switch to Hawaii salary calculator. If you are running a business that is selling. The results are broken up into three sections.

Withholding is required on. This marginal tax rate means that your immediate additional income will be taxed at this rate. If you make 70000 a year living in the region of Hawaii USA you will be taxed 14386.

You can use our free Hawaii income tax calculator to get a good estimate of what your tax liability will be come April. Use ADPs Hawaii Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The services are performed by an employee whose regular place of employment.

Employees reconcile their withholding taxes paid as part of their Individual Income tax return. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. For instance an increase of 100 in your salary will be taxed as 3805.

The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. The Paycheck Calculator. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

Calculate your Hawaii net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Hawaii paycheck calculator. If youre a new employer congratulations you pay a flat rate of 3. It is not a substitute for the advice of an accountant or other tax professional.

The 2022 tax rates range from 02 to 58 on the first 500 in wages paid to each employee in a calendar year. Neither these calculators nor the providers and affiliates thereof are providing tax. Below are your Hawaii salary paycheck results.

All Services Backed by Tax Guarantee. 2022 tax rates for federal state and local. This Hawaii hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Secondly your FICA taxes will be calculated at 765 including social security at around 62 and Medicare at 145. Ad Payroll So Easy You Can Set It Up Run It Yourself. Important note on the salary paycheck calculator.

A Wages for services performed in the State. Search jobs Search salary. These calculators should not be relied upon for accuracy such as to calculate exact taxes payroll or other financial data.

In addition you are responsible for. Calculate your federal Hawaii income taxes Updated for 2022 tax year on Aug 31 2022. Your average tax rate is 1198 and your marginal tax rate is 22.

Switch to Hawaii hourly calculator. That means that your net pay will be 41883 per year or 3490 per month. Why Gusto Payroll and more Payroll.

Hawaii also has a small disability insurance tax as well which has a maximum cap on the applicable income. The calculator on this page is provided through the ADP. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

From 262500 to 300000. Hawaii Income Tax Calculator 2021. Details of the personal income tax rates used in the 2022 Hawaii State Calculator are published below the calculator.

Hawaii State Unemployment Insurance SUI As an employer in Hawaii you have to pay unemployment insurance to the state. First of all your income is taxed at 44 which means your Hawaii state tax ranges from 39 while your Hawaii State Disability Insurance will be calculated at 05. The results are broken up into three sections.

Your results have expired. Your average tax rate is 239 and your marginal tax rate is 381. Use the Hawaii bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Hawaii. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Employers then pay the withheld taxes to the State of Hawaii Department of Taxation DOTAX.

Hawaii Salary Paycheck Calculator. The Hawaii Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Hawaii State Income Tax Rates and Thresholds in 2022. Automatic deductions and filings direct deposits W-2s and 1099s.

Hawaii Hourly Paycheck Calculator.

Oregon Paycheck Calculator Adp

Updates For Taxpayers Department Of Taxation

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Santa Clara County Ca Property Tax Calculator Smartasset

2

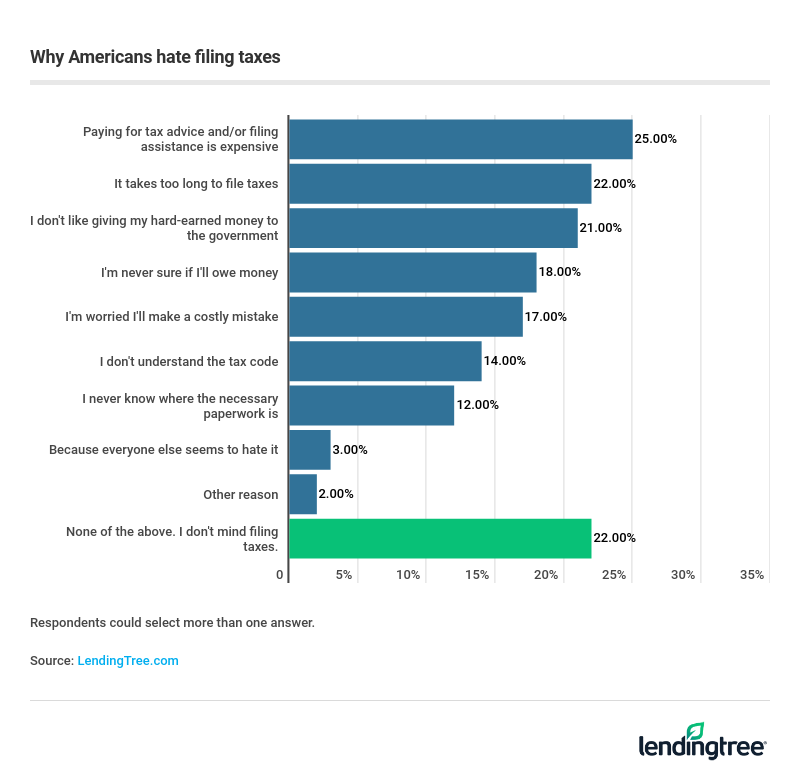

Most Americans Dread Doing Taxes But 4 In 10 Rely On Refunds

Riverside County Ca Property Tax Calculator Smartasset

I Live In One State Work In Another Where Do I Pay Taxes Picnic

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Federal And State W 4 Rules

These States Have The Highest And Lowest Income Tax Burdens Study Finds

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

2

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

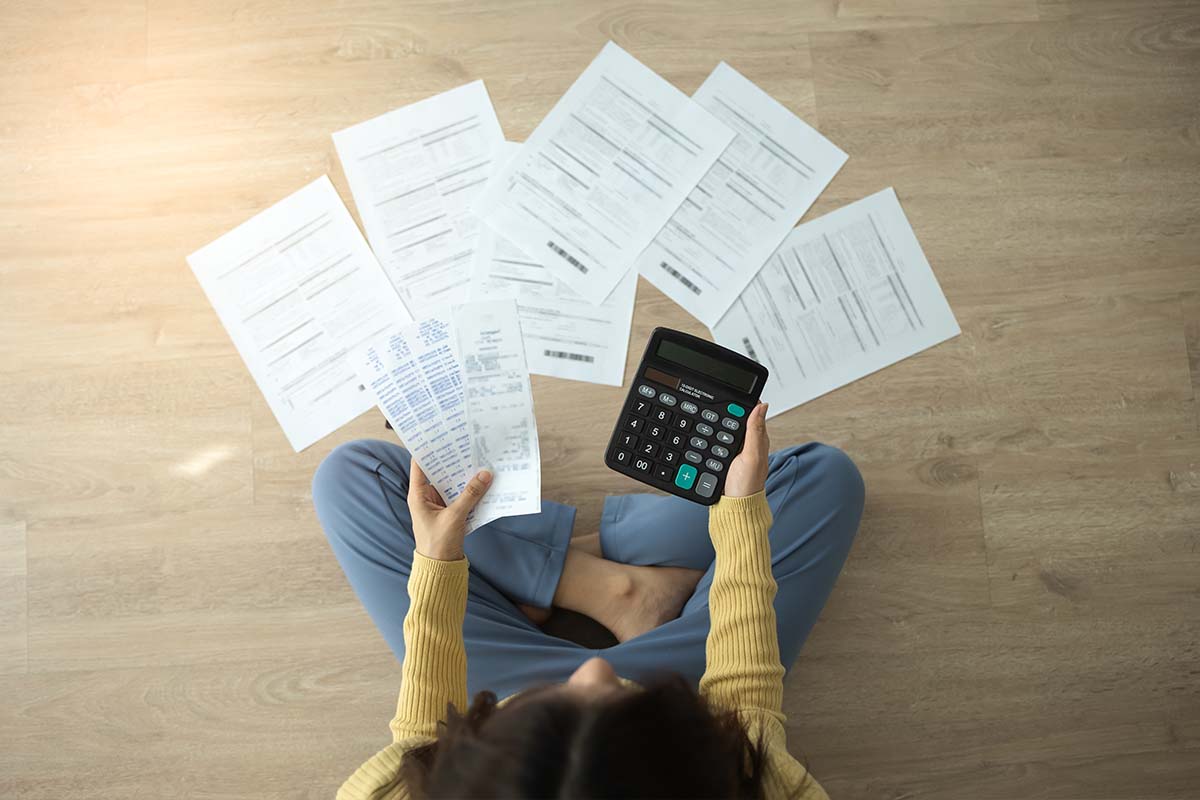

4 Steps To Be More Financially Conscious This Year Hawaii Home Remodeling Debt Collection Managing Your Money Consumer Debt